Understand Your Needs and Budget

Identifying the right luxury car begins with pinpointing your specific needs. Consider factors like daily commute, family size, and personal preferences. For example, a spacious SUV fits a family of five, while a sleek coupe matches a single professional’s lifestyle. Understanding these details helps narrow down options.

Budgeting accurately comes next. Determine your monthly lease payments, including insurance and maintenance. Leasing calculators on car dealership websites can estimate potential costs. Aim to spend no more than 15% of your monthly income on car payments to ensure financial comfort.

Evaluate how long you plan to keep the car. Typical lease terms range from 24 to 36 months, affecting overall cost. Shorter terms may offer flexibility but higher payments. Longer terms lower monthly costs but increase the long-term commitment. Balancing these factors ensures a lease that matches both your needs and budget constraints.

Furthermore, anticipate additional fees. Consider costs like:

- acquisition fees

- security deposits

- potential charges

for excess wear or mileage overages. Knowing these upfront avoids surprises and helps stay within your budget.

Research the Market

Conducting thorough research is crucial for securing the best luxury car lease deals. Understanding the current market trends and comparing options can help identify favorable terms.

Compare Different Dealerships

Visit various dealerships to gather lease offers. Individual dealerships often have varying prices and terms. Collect brochures and speak with sales representatives to capture details. Comparing multiple lease proposals ensures better insight into competitive offers. Use online tools like Edmunds and Kelley Blue Book to compare dealership inventory and pricing.

Look for Seasonal Offers

Capitalize on seasonal promotions to benefit from significant discounts. Dealers frequently roll out attractive leasing deals during holidays like Memorial Day, Labor Day, and the end of the calendar year. Monitoring these times can result in lower monthly payments or additional incentives. Keep an eye on manufacturer websites and subscribe to dealership newsletters for notifications on upcoming deals.

Negotiate the Lease Terms

Negotiating lease terms can save you considerable money on a luxury car lease.

Focus on the Monthly Payment

Concentrate on getting a lower monthly payment. Leasing companies use your monthly payments to calculate your overall cost. Consider the capitalized cost, the initial amount used to determine your monthly payments. Look for ways to reduce this cost, like leveraging upfront payments or negotiating a higher trade-in value. Aim for payments that fit your budget without compromising the car’s value.

Discuss the Residual Value

- Pay attention to the car’s residual value. This value is the estimated worth of the car at the lease’s end.

- A higher residual value often leads to lower monthly payments.

- Manufacturers with strong reputations typically offer cars with higher residual values.

- Make sure the residual value aligns with the market to avoid overpaying.

- Validate the given residual value by comparing it with industry standards on resources like Kelley Blue Book or Edmunds.

Consider Lease-Specific Incentives

Securing the best luxury car lease deals often involves leveraging lease-specific incentives. Knowing where and how to find these incentives makes a considerable difference in the overall cost.

Manufacturer Rebates

Manufacturers frequently offer rebates to make leasing more attractive. These rebates can significantly lower the lease’s overall cost. For example, Mercedes-Benz occasionally provides lease cash incentives that directly reduce the vehicle’s capitalized cost. Checking the manufacturer’s website or contacting dealers helps identify current rebate offers.

Dealer-Specific Promotions

Dealers often have their promotions to move inventory quickly. These promotions can include special lease rates, bonus cash, or limited-time offers. For instance, a dealer might offer a zero-down lease special on select models. Visiting multiple dealerships and asking about ongoing promotions enables you to compare and find the best deal.

Check the Fine Print

Leasing a luxury car involves understanding many details. It’s crucial to meticulously review the lease agreement to ensure there are no surprises.

Mileage Limits

Mileage limits directly impact lease terms. Most leases offer 10,000 to 15,000 miles per year. Exceeding these limits incurs additional fees, usually calculated per mile. For example, exceeding the limit by 5,000 miles at $0.25 per mile results in an extra $1,250. Adjust the mileage limit at the beginning if you anticipate higher use to avoid these fees.

Wear and Tear Policies

Wear and tear policies vary between lessors. They define the acceptable condition of the vehicle upon return. Common policies include charges for dents, scratches, and tire wear. For instance, BMW’s policy may charge $200 for minor damages like scratches. Pre-inspect the car and document its initial condition. This helps avoid disputes and potential charges at the lease end.

Finalize the Lease Agreement

After negotiating the best deal, carefully finalize the lease agreement to ensure no unexpected costs or conditions arise later.

Review All Terms Carefully

Double-check all lease terms before signing. This includes not only the monthly payments and lease duration but also any additional fees. Verify the capitalized cost, residual value, and any extra charges such as acquisition fees. Ensure the mileage limit fits your driving habits to avoid penalties. Confirm wear and tear clauses to understand your responsibilities for vehicle condition. Scrutinize every aspect for complete clarity.

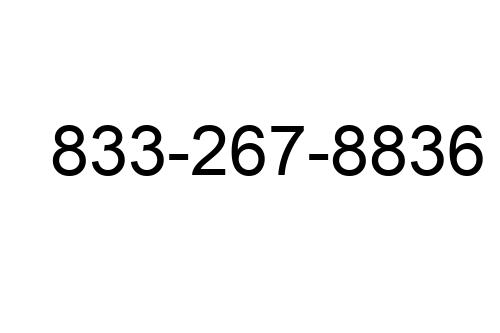

Seek Professional Advice

Consult a financial advisor for expert advice on lease agreements. An advisor helps interpret complex terms and provides valuable insights into whether the deal aligns with your financial goals. If needed, a legal advisor reviews the contract to ensure there are no hidden clauses. Professional input ensures you make a fully informed decision when leasing a luxury car.

Founder & CEO

Founder & CEO